Four

segments.

One goal:

High-yielding seeds

During fiscal year 2022/23, the KWS Group performed exceptionally well in a marketplace characterized by relentless challenges — generating strong double-digit growth in net sales and earnings. All segments and regions contributed to this growth.

Sugarbeet

KWS, the global market leader in sugarbeet seeds, sharply boosted its net sales and earnings in this

area once again.

- ■ Due to favorable market conditions, farmers obtained higher prices for sugarbeet, a development that enhanced this plant’s appeal. The size of global cultivation areas for sugarbeet rose by about two percent to 4.5 million hectares.

- Our CONVISO® SMART and CR+ varieties were the main drivers of the strong performance of KWS’s business. These innovations make an important contribution to achieving stable sugarbeet yields, even under pest and disease pressure, while reducing the use of pesticides.

- We also invested in key seed-production processes: This includes the construction of an elite seed storage facility in Germany and the expansion of production facilities in Italy.

Net sales 2022/23

in M€

EBIT 2022/23

in M€

Corn

Net sales in the Corn Segment exceeded the one-billion-euro mark for the first time, but its earnings declined.

- While more corn was grown in the United States, the size of cultivated area declined in Europe. The intense drought conditions experienced here in recent years have hurt yields and prompted farmers to increasingly cultivate different crops.

- We were able to boost net sales in the core markets of Europe and Brazil primarily as a result of higher prices. The main reason for the decline in earnings was the significantly lower profitability of our joint ventures in North America and China.

- As previously announced, KWS also continued investment in the comprehensive expansion of its seed-processing facility in Ukraine. The aim of this work is to ensure the availability of high-quality seed and to support the rehabilitation of the agricultural industry even against the backdrop of the persisting war of aggression against Ukraine.

Net sales 2022/23

in M€

EBIT 2022/23

in M€

Cereals

Our cereal seeds portfolio is in high demand — net sales climbed primarily as a result of the dynamic growth in oilseed rape, wheat and rye seeds.

- ■ In light of the continuing strong demand for agricultural commodities and the overall high level of prices for farmers, the cultivation of cereals remains a promising business.

- In addition to higher net sales for oilseed rape, wheat and rye seeds, the future-oriented business with seeds for catch crops, sorghum and organic farming developed very well. As a result of increased demand and higher seed prices, earnings rose sharply at 36 percent.

- During the fiscal year, the company laid the foundation for future growth by expanding and modernizing its production facilities and breeding stations.

Net sales 2022/23

in M€

EBIT 2022/23

in M€

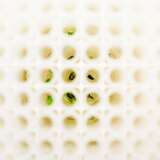

Vegetables

The expansion of the newest segment continues: KWS now has vegetable breeding stations in Spain, Italy, the Netherlands, Turkey, Brazil and Mexico.

- Spinach seed is the largest product category for KWS in this segment – market conditions are stabilizing here after the end of the corona pandemic.

- Largely due to the sale of spinach and bean seeds as the second-largest product category in the Vegetable segment, net sales rose sharply by 21.5 percent.

- The expansion of the segment with breeding programs for tomatoes, peppers, cucumbers, melons and watermelons will require many years of large investments, particularly in research and development. This led to a planned negative result in earnings. But, in comparison with last year, this metric improved mainly thanks to the business performance.

Net sales 2022/23

in M€

EBIT 2022/23

in M€